- CycleGF Team

- Dec 3, 2024

- 4 min read

Updated: Dec 10, 2024

10 Principles of Warren Buffett in Choosing a Stock or ETF

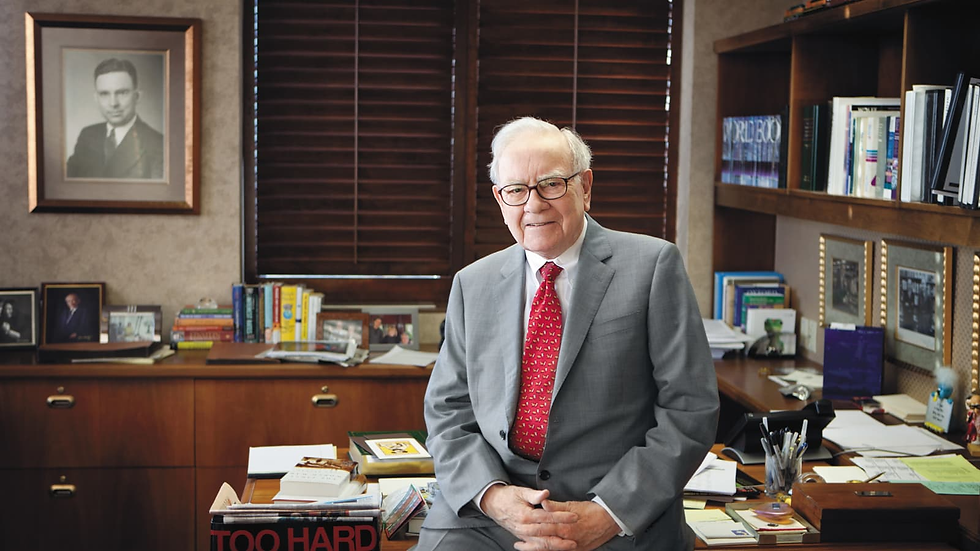

Warren Buffett, the legendary investor and chairman of Berkshire Hathaway, is widely regarded as one of the greatest investors of all time. His investment philosophy has earned him billions, and his principles are widely studied by aspiring investors worldwide. Buffett’s approach to stock and ETF selection focuses on long-term value, strong management, and a durable competitive advantage.

In this article, we’ll explore the 10 principles of Warren Buffett that guide his decisions when choosing a stock or ETF, and how you can apply these timeless strategies to your own investing journey.

1. Invest in What You Understand

Warren Buffett famously says, “Never invest in a business you cannot understand.” This principle, often referred to as staying within your "circle of competence," is one of Buffett’s most fundamental rules. Before investing in any stock or ETF, you must understand how the business operates, what it does, and the factors that drive its success.

Principle: Focus on industries and businesses you understand deeply, ensuring you can make informed decisions.

2. Look for a Strong, Sustainable Competitive Advantage

Buffett calls this a "moat." He favors companies with a durable competitive advantage, meaning businesses that have unique attributes that protect them from competition. This could be in the form of strong brand recognition, cost advantages, or exclusive intellectual property. Companies with a wide moat are more likely to maintain profitability over time, even in challenging market conditions.

Principle: Invest in companies with a competitive advantage that can withstand economic and competitive pressures.

3. Consistent and Predictable Earnings

Buffett seeks companies with a track record of consistent earnings growth over a long period. He values businesses that can generate reliable profits year after year, rather than speculative ventures or those with unpredictable earnings. This predictability allows Buffett to make informed judgments about the long-term potential of the business.

Principle: Choose companies with a history of steady and predictable earnings growth.

4. Focus on the Quality of Management

Buffett places a high premium on the quality of a company’s management team. He believes that good management is essential for the long-term success of any business. He looks for leaders who are honest, capable, and have the ability to make sound decisions. For ETFs, this extends to the fund managers or the team behind the ETF’s strategy.

Principle: Invest in businesses led by trustworthy, capable, and competent management teams.

5. Look for Companies with High Returns on Equity (ROE)

Buffett pays close attention to Return on Equity (ROE) because it indicates how efficiently a company uses its shareholders' equity to generate profits. A high ROE is often a sign of a well-managed, efficient business. Companies with strong ROE figures typically reinvest earnings into growth, fueling further value creation.

Principle: Invest in companies with high returns on equity, demonstrating strong operational efficiency.

6. Favor Low Debt Levels

Buffett is famously conservative when it comes to debt. He prefers companies with low levels of debt or those that can manage debt prudently. High debt increases financial risk, especially in volatile markets, as companies may struggle to meet obligations during tough times. Low debt allows businesses to weather downturns without as much risk.

Principle: Avoid companies with excessive debt. Look for businesses with a conservative approach to borrowing.

7. Invest in Businesses with a Long-Term View

Buffett is known for his long-term investing approach, and this extends to his stock and ETF picks. He is not interested in short-term gains or market timing. Instead, he invests in companies he believes will thrive over decades. This means avoiding speculative stocks or assets that may offer temporary gains but lack long-term sustainability.

Principle: Take a long-term view and invest in businesses that will continue to succeed for years or even decades.

8. Buy at a Fair Price, Not at Any Price

Buffett often says, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” He believes that the price you pay for a stock or ETF is just as important as the quality of the investment itself. Even great companies can be bad investments if purchased at an inflated price.

Principle: Be patient and wait for a fair price. Don’t overpay for quality investments.

9. Focus on Intrinsic Value, Not Market Trends

Buffett emphasizes the importance of focusing on intrinsic value—the true value of a company based on its fundamentals—rather than being swayed by market trends or short-term noise. He advises looking beyond price fluctuations and focusing on the company’s core value, future growth prospects, and economic moat.

Principle: Invest based on intrinsic value, not market trends or short-term speculation.

10. Diversification Should Be Based on Quality, Not Quantity

While many investors focus on diversification as a way to spread risk, Buffett believes that concentration is a better strategy for successful investing, particularly for those who are highly knowledgeable in specific sectors. He argues that diversification works well for average investors who don't have the time to study companies deeply. However, for experienced investors, investing heavily in a few high-quality stocks or ETFs can yield higher returns.

Principle: Don’t over-diversify; focus on high-quality investments.

Conclusion

Warren Buffett’s approach to stock and ETF selection is rooted in sound principles that prioritize long-term value, quality, and a disciplined approach to investing. By adhering to these 10 principles, you can align your portfolio with Buffett’s investment philosophy and improve your chances of building wealth over time.

These principles include focusing on businesses you understand, investing in companies with a durable competitive advantage, seeking predictable earnings, and evaluating management quality. Moreover, Buffett advises you to be patient, avoid high levels of debt, and always purchase investments at a fair price.

By applying these rules to your own portfolio, you can avoid speculative investing and instead focus on solid, long-term investments that will stand the test of time—just like Buffett’s.

Comments